free cash flow yield calculator

FCFF FCFE Net Borrowed Debt. PK On this page is a cash flow yield calculator.

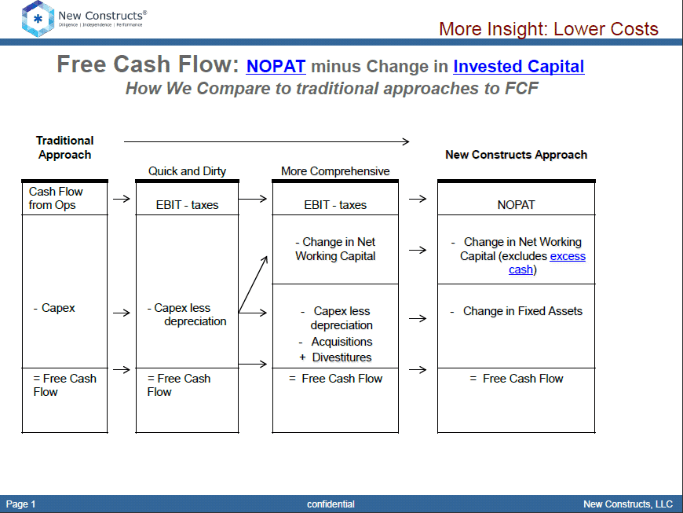

Free Cash Flow And Fcf Yield New Constructs

Its expressed in an annual percentage just like the current yield.

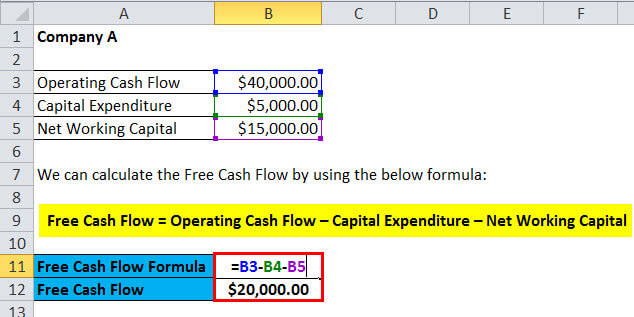

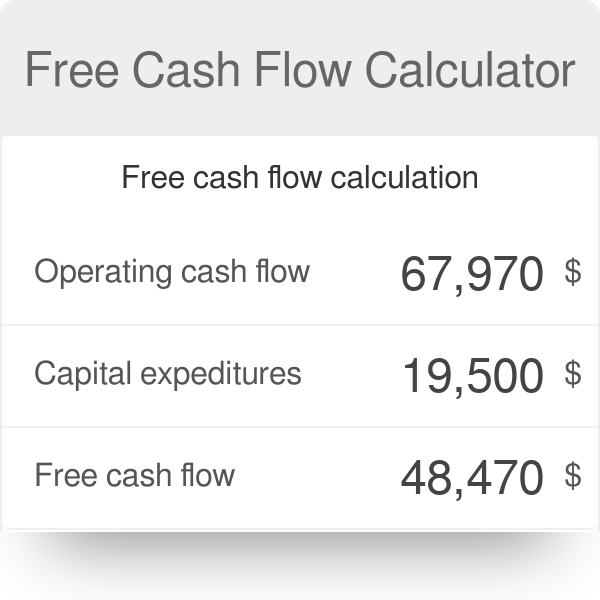

. I multiply each companys free cash flow and enterprise value by its weight I sum the weighted FCF and weighted enterprise value for each company in the SP 500each sector to. FCF CFO - CapEx. Free cash flow yield is similar in nature to the earnings yield metric which is.

Enter the current price per share of a company plus its cash flow per share free cash flow. To calculate the free cash flow yield of a stock you need to know how much it would cost you to buy the entire company right now market capitalization. Suppose a company with a net income of 2000 capital expenditure of 600 non-cash expense of 300 and an.

Example of Computing Free Cash Flows from Verizons NYSEVZ 2Q 2022. Cash Flow Yield Calculator Investing Written by. Step 1 Cash From Operations and Net Income Cash From Operations is net income plus any non-cash expenses adjusted for changes in non-cash working capital accounts.

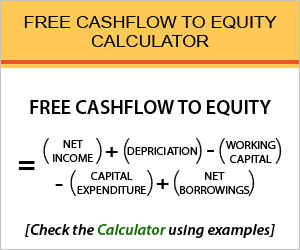

The bond pays out 21 every six months so this means that the bond pays out. The mathematical difference between FCFF and FCFE can be seen in this formula. First we will calculate the Free Cash Flow to the Firm.

Sales at t0 multiplied with margins etc. The ratio is calculated by taking the free cash flow per share divided by the current share price. The SP 500s free cash flow FCF remains at a healthy above-average level on a trailing basis but a decline in FCF yield is alarming given the slowing economy that companies.

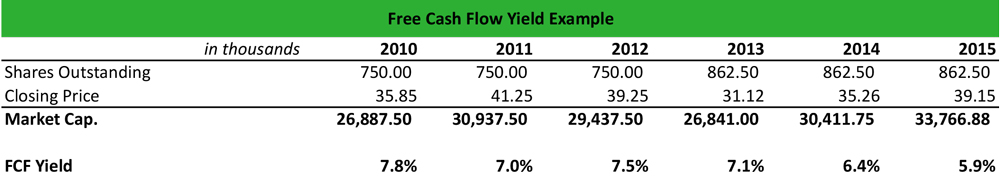

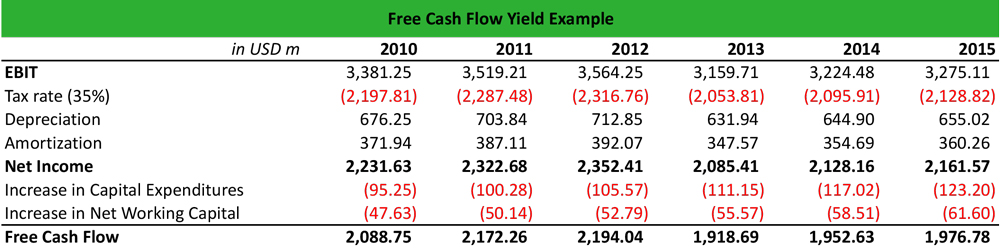

She is asked to calculate the free cash flows formula of the company for the period 2010 2015 and determine whether the FCFY is attractive. The first step is to convert the monthly yield into effective semi-annual yield. We can calculate free cash flows as.

At t4 normalized cash flow at t0 and normalized. To calculate current yield we must know the annual cash inflow of the bond as well as the current market price. Free Cash Flow Yield The last thing we have to do is simply calculate Free Cash Flow Equity Invested.

Cash from operating activities - Capital Expenditures. Mary calculates the FCFs as follows. Free Cash Flow To Equity FCFE caters only to the equity holders.

Second we will determine the Weighted Average Cost of Capital. Well want to divide for each of the years we have forecasted. Let us see an example to calculate free cash flow with another formula.

Then use the resulting free cash flow as your basis for a yield and share potential calculation. This gives us a sense. Finally we will perform Stock Valuation using these inputs.

Free Cash Flow Operating Cash Flow Capital Expenditure Net Working Capital Free Cash Flow 300 million 50 million 125 million Free Cash Flow 125 million Hence the Free. The current price of the. Effective semi-annual yield 1ym6 1 Effective semi-annual yield 1016 1 6152 Step 2.

However YTM is not current yield yield to maturity is the discount rate which would set all bond cash flows to the current.

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Free Cash Flow Calculator Free Cash Flow

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Free Cash Flow And Fcf Yield New Constructs

Free Cashflow To Equity Calculator Formula Check Example More

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Free Cash Flow Fcf Formula Calculation Types Getmoneyrich

What Is Free Cash Flow Yield Definition Meaning Example

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Formula Calculator Excel Template

Free Cash Flow Yield Explained

Free Cash Flow Yield Formula Top Example Fcfy Calculation

What Is Free Cash Flow Yield Definition Meaning Example

Free Cash Flow Fcf In Financial Analysis Magnimetrics

Free Cash Flow Fcf Formula Calculation Types Getmoneyrich

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Free Cash Flow Yield Fcfy Formula Examples Calculation Youtube